I’m writing just as the Chancellor has announced no changes to the Section 24 tax regime for landlords – OK, we could but hope – so I thought it’s time to address a key issue that I come across a lot in online landlord forums and Facebook Groups: do landlords properly understand the impact that interest rates plus Section 24 are having on their finances? It’s not enough for rent rises to just cover the interest rate hikes. This article aims to explain why.

I’m going to come back later to some positives for landlords, some help that we can offer to calculate the numbers in your situation, and some strategies to consider. But first we ought to look at mortgage tax relief for landlords as a general topic.

Section 24 tax is a game-changer for landlords

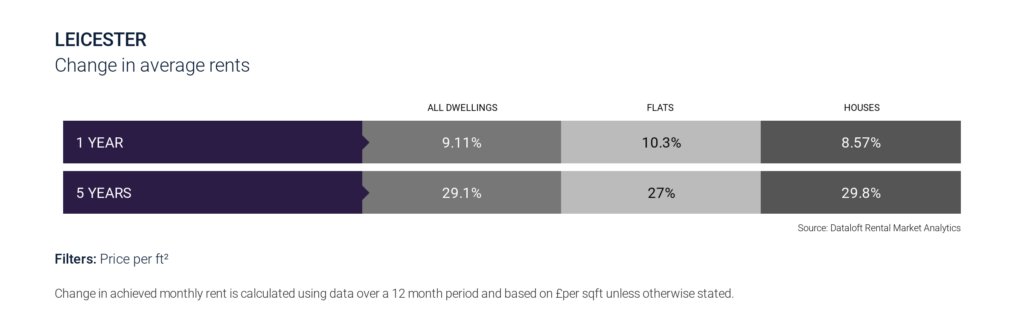

All landlords can see rents rising to cover the huge change in interest rates brought about by the Bank of England hiking Base Rate 15 times since November 2021. Sadly tenants are having to see this too, as rents are up by near double-digit percentages, which is obviously a tough thing in a cost of living crisis.

When Section 24 tax changes were announced in 2015 they instantly got dubbed “the Tenant Tax”. Easy to see why.

Here’s a chart on the local impact. You can see over 9% average increase in rents just in the last year:

The thing is, when I’m reading informative Facebook Groups to gauge landlord opinion I’m regularly struck by how landlords will breathe a sigh of relief because they’ve upped the rent to cover the mortgage. Obviously that seems fine on the face of it (to the landlord, at least).

But Section 24 changes the calculus: a landlord is now taxed on their full rental income, with just a 20% tax credit against the cost of the mortgage finance. Covering the cost of the mortgage alone doesn’t cut it any more. In the past the whole of the mortgage cost was a deductible allowance against tax – but no longer.

You might want to look at the Government’s own guidance to changes to tax relief for residential landlords here, for clarification (note – their tax rates are out of date, though).

A Quick Case Study: Tax Changes for buy to let landlords

These are numbers that the Government itself uses to illustrate the impact of tax deduction of mortgage interest. So this is the picture pre-Section 24, way back in 2016/17:

| John has Self Employment income | £35,000 | ||

| Property Income Calculation | Rental Income | £18,000 | |

| Finance Costs (i.e. the btl mortgage) | £8,000 | ||

| Other allowable expenses | £2,000 | ||

| Property Profits | £8,000 | ||

| Total Income | £43,000 |

So the landlord is taxed on £8000 of property profits based on whatever their marginal tax rate is. In this instance “John” is a base rate payer because his total income is £43,000, so he pays £1600 in tax.

The Government then calculates that by 2020/21the impact of the change would be :

| John has Self Employment income | £35,000 | ||

| Property Income Calculation | Rental Income | £18,000 | |

| Finance Costs (£8,000 of btl mortgage) | Nil deduction | ||

| Other allowable expenses | £2,000 | ||

| Property Profits | £16,000 | ||

| Total Income | £51,000 | ||

| Less 20% tax credit on finance costs | -£1.600 |

So, if you are working your way through the Government’s figures, the property is now making £16,000 of profit – same property, just twice as “profitable”, because John cannot now deduct his mortgage costs. Now, if John had remained a basic rate tax payer, the tax on the increased Property Profits would be 20% of these profits, equalling an additional £3,200. But, this would have been offset by the Tax Credit of £1,600, bringing the total tax bill on the property profits back to where it was previously.

(The Government estimated this would be the case in the majority of landlord cases. Their site says: “Sophia is one of the estimated 82% of landlords that don’t have any additional tax to pay because her total income, without a deduction for finance costs, doesn’t exceed the higher rate threshold”).

But he hasn’t stayed a basic rate tax payer. His completely unchanged rental situation on his property has moved him into the higher rate band and he has to absorb £1,600 of additional tax. Nasty, but arguably not ruinous. But, bear in mind, the total revenue from the buy to let is regarded as John’s income, no longer just the nett profit from owning the rental property. So even if that were now making a loss it has moved John up a peg in the tax stakes.

The Realities Section 24 Landlords Face

The Base Rate rises change everything: here’s the true situation. First, the landlord’s total income has risen because the whole rent is regarded as income. In the example above, that’s £18,000, and his new “higher” income is taxed at 40%. And the more a landlord pushes the rent up to cover the mortgage, the more they are going to get taxed – and now at a higher rate – on this income.

What happens when interest rates raise on top of the tax change?

This is where Section 24 becomes a real issue for any landlord with a mortgage. The maths start to seriously work against the landlord as the impacts of both this alteration to tax relief on mortgage interest and interest rates start to bite.

So, if we look at the Government’s own example numbers again, here’s how they get re-worked in a rising interest rate climate. Let’s start with some basic assumptions:

- Let’s say the rent is kept the same, just so we have a completely fair and direct comparison

- The mortgage finance cost at £8,000 in the Government example on a tracker interest rate of 2.5% over the base rate of 0.1% (very typical in 2016/17) would have funded a mortgage of £307,700. That’s a reasonably sizeable buy-to-let mortgage in Leicester terms, which at 65% loan to value equates to a four bedroom house valued at £473,000 – a fair value and mortgage situation.

- Today’s base rate is 5.25%. So the financing cost has now risen to 5.25% plus the tracker of 2.5%

| John has Self Employment income | £35,000 | ||

| Property Income Calculation | Rental Income | £18,000 | |

| Finance Costs (£23,846) | Nil deduction | ||

| Other allowable expenses | £2,000 | ||

| Property “Profits” | £16,000 | ||

| Total Income | £51,000 | ||

| Less 20% tax credit on finance costs | -£4769 |

So, John is still making property “profits” of £16,000. This is the Rent of £18,000, less the allowable expenses.

But look at that interest rate burden on his Tracker mortgage: nearly £24,000!

So John will now have financing costs of £23,846 less the tax credit (at basic rate) of £4769. That’s £19,077 of financing costs on his buy-to-let mortgage. And remember, he’s only “making” £16,000.

Because John has magically moved into the higher rate band, he’s now going to be paying tax on those “profits” at 40%, plus he’s got financing costs of over £19,000.

Two things will happen: clearly John looks at this and thinks “heck, the rent has got to go up”. He has to push rent up as much as possible to defray the cost of the mortgage. And/or as a landlord he decides that even if he can do that and just about cover things post-tax, it’s a pretty unappealing investment, so he opts to exit. The landlord can push rents up, but the gap in this Government-inspired hypothetical example is a big one to bridge.

How Can A Landlord Easily Check The True Section 24 Tax Position?

Landlords need a way to check their situation around buy to let tax changes. You need to be able to look at the deeper impact of Section 24 tax to know what’s the right way to deal with your rental investment.

Here’s something to help: our Tax and Interest Rate Calculator. It’s a ready-reckoner that allows you to look at the impact of Base Rates and tax rates in your own situation, for any level of rent and any level of mortgage. Use it to:

- Assess how much rent has to increase by to be truly resilient against tax and mortgage rates, or…

- Assess what you should do to bring your outstanding mortgage down

- Give you a practical base to talk to us at Northwood Leicester about how local rents are looking

- Consider whether a change of strategy, shrinking from two or more properties to fewer, might work

- Assess whether that re-mortgage you’re looking at is the right rate you need

- Negotiate harder on the purchase price of your upcoming buy to let property

Some caveats: this is not tax advice – it’s a landlord Section 24 tax and interest ready reckoner. It’s something to enable a landlord to see some perhaps startling realities, but it is no substitute for formal advice from an accountant or professional tax advisor that would take full account of an individual’s personal income situation. It’s there to help with the thinking and the calculations, but it’s not intended as advice.

What Can Landlords do about Section 24 Tax?

There are upsides, of course, and some mitigating strategies.

Not every landlord has a mortgage. Those happy unencumbered folk are seeing rents rocket, which may be useful if they do decide to take advantage of a rising market.

It has to be said that mortgaged landlords that decide to hold their rents below market rent levels may be creating problems for themselves down the road. If you go to your lender for a re-mortgage that’s now applying up to 165% stress tests, a discounted rent will potentially deliver a very poor loan borrowing outcome. Talk to us at Northwood Leicester about mortgage advice and how to strategise your approach where the rent is concerned.

For many landlords the right option might be to sell one out of a multiple portfolio, spread the sale proceeds around the remaining properties to reduce loan-to-values, and take advantage of rising rents to improve overall cashflow on a slightly smaller portfolio. If so, again, Northwood Leicester has decades of experience in selling tenanted and ex-rental properties on behalf of landlords. Check out our Estate Agency platform here: northwoodleicester.com/sales.

Speak to Gosia or Abby for advice on how the market is looking for sales.

WhatsApp us on 07594 476403.

For some landlords incorporation is the route forward. Companies do not face the Section 24 landlord conundrum because they can still offset their mortgage finance costs. That’s the position for the present, and we hear nothing adverse on this topic.

But incorporation is a tough topic to confront and you will likely need expert tax and financial advice. I have outstanding contacts that I’d be pleased to introduce to minded landlords. But I emphasise that this is a subject that requires very sound professional advice.

Conclusions: Tax Relief on Mortgage Interest – can we have it back, please?

The basic logic behind Section 24 tax was stated by George Osborne in the preamble to the Finance Act 2015 as intended to:

- Curb the private rental market by making it less attractive to landlords

- Stop higher earners from claiming back large amounts of tax relief

- Increase the level of housing stock and give first-time buyers a greater opportunity to get a foothold on the property ladder

So how’s that working out? First, tenants now have less free cash to save for a deposit, unfortunately. And second, the Private Rented Sector that does so much to provide housing that the social and council sectors can’t is inexorably shrinking under the financial burden. A classic case of unintended consequences.

In several decades of buying rental investments I have never once come up against a first-time buyer. They simply do not want to buy the kinds of properties that I do. I look at buying an under-priced property in an area of strong rental demand, and I invest heavily to bring it up to best-house-in-the-street level. That way I reckon that it rents quickly to a wide range of prospective tenant types. I take the hit on the investment required in expectation of a long-term return, and I provide much-needed housing. But first-time buyers want a finished idealised home that matches a lifestyle need. One that simply isn’t delivered by the original unloved or even run-down property that I would consider. This is the way property investors do it: we don’t deprive first-time buyers in the slightest.

So the basic premise of Section 24 and its reduction in mortgage tax relief is a nonsense. For the moment we are where we are, but maybe, just maybe, the penny will drop and the crucial importance of landlords for the provision of decent housing will sink home. Which is the norm, whatever the press would have the world believe.

Landlords are after all generally only saving in a bricks and mortar way for a pension or for their own family’s long-term security. Why is it necessary to put that positive outcome in peril?

Get your Tax And Interest Rate Calculator here.Or pop in and talk to us about your situation. And your details via this form will reach us at any time and ensure a prompt response.