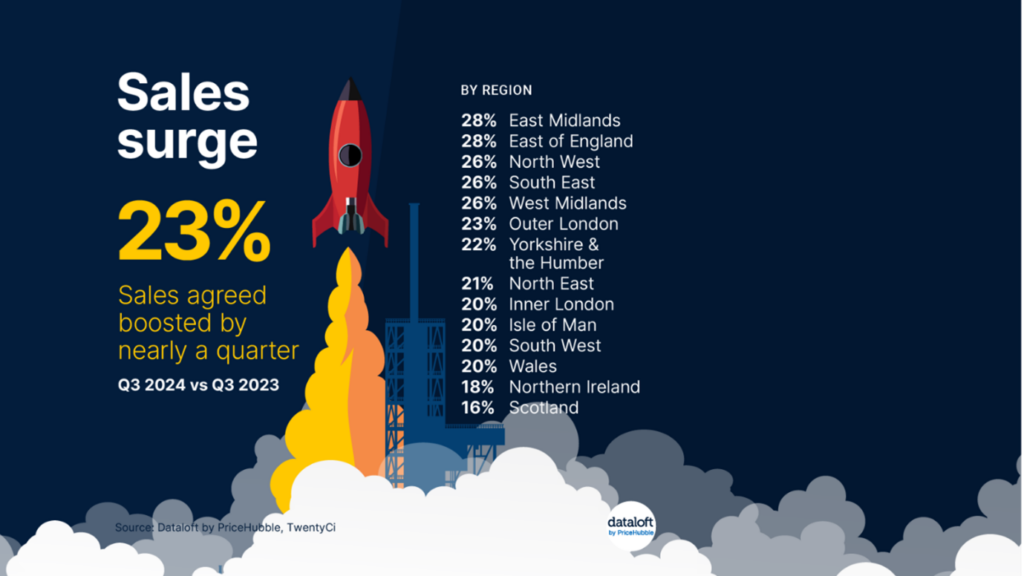

The UK property market has seen a remarkable uptick in sales activity this year, with a recent surge largely driven by falling mortgage rates. According to data from Dataloft, 332,200 sales were agreed across the UK in Q3 2024, representing a 23% increase from the same period last year. While 2023 was an unusually low baseline for comparison, this year’s figures have also surpassed pre-pandemic levels, showing a 7% rise compared to Q3 2019—a robust benchmark for the property market.

For potential buyers, sellers and investors, these figures signal a shift in the market. This article delves into the trends behind these numbers, explores regional variations and considers what the future might hold for those involved in UK property.

Falling Mortgage Rates and the Boost to Sales Levels

A key factor driving this surge in agreed sales is the significant drop in mortgage rates. As of September, the average interest rate for two-year fixed mortgages fell to 5.0%, while five-year fixed rates were down to 4.5%. These are the lowest levels we’ve seen since April and May 2023, which has encouraged a rise in borrowing and buying. For many prospective homeowners, these reductions in mortgage rates are making the prospect of homeownership more accessible, leading to an increase in the number of transactions.

The decrease in mortgage rates is especially notable given the financial volatility seen over the past two years. As the Bank of England adjusted base rates to control inflation, mortgage rates rose sharply, leaving many prospective buyers hesitant to commit. Now, with mortgage rates stabilising and declining, confidence in the market is rebuilding. The affordability of borrowing has improved, and potential homeowners are now more willing to move forward with purchases, driving a considerable increase in sales agreements.

A Strong Market Comparison: 2019 as a Benchmark

Though the market faced considerable challenges in 2023, comparing 2024’s figures to those from 2019 provides a more meaningful benchmark. In Q3 of 2024, sales agreed were up by 7% compared to Q3 of 2019, a period considered to be a stable, pre-pandemic market year. This rise illustrates the resilience of the property market and indicates that the current momentum is not merely a rebound from a low point but a robust recovery.

The 2019 comparison reinforces the idea that the UK property market is experiencing genuine growth rather than just a temporary spike. This positive trend, with sales levels outpacing even pre-pandemic figures, suggests that the market’s underlying factors—such as buyer demand, mortgage accessibility and a growing supply of properties—are supporting sustained activity.

Regional Performance: East of England and East Midlands Lead the Way

The rise in agreed sales has been consistent across all UK regions, though some areas have seen particularly impressive growth. Leading the pack are the East of England and East Midlands, each experiencing a 28% increase in sales agreements over the past year. This surge is likely influenced by a mix of affordable housing stock, strong local economies and improved mortgage rates.

For example, areas in the East of England—spanning from Essex up to Norfolk—have continued to attract buyers seeking a balance between commuter convenience and countryside lifestyle. In the East Midlands, cities such as Leicester, Nottingham and Derby are offering affordable alternatives to the more expensive south, drawing in young professionals, families and investors alike.

This regional diversity highlights that the UK’s property market is not only rebounding but thriving, with opportunities for buyers in both urban and rural locations. Increased demand across regions has kept the market dynamic and competitive, ensuring that both sellers and buyers benefit from this growth.

A Boost in Property Supply: Highest Level in Six Years

One of the most encouraging trends supporting this rise in sales is the increase in property supply. According to TwentyCi, the number of properties listed for sale has risen to 456,902—up by 9% year-on-year and marking the highest level in six years.

This surge in property supply benefits buyers, giving them a broader range of options and reducing the intense competition for homes that characterised the market in recent years. A healthy supply also stabilises prices, making it easier for more people to enter the market without facing prohibitive costs.

The increase in supply also reflects growing confidence among homeowners in the current market. As mortgage rates have fallen and demand has risen, sellers feel more assured of finding willing buyers, prompting more homeowners to list their properties.

The Outlook for Buyers and Sellers

With mortgage rates stabilising, sales rising and supply increasing, the UK property market appears set for continued growth into the coming quarters. Buyers can expect a relatively stable market with a wider choice of properties, though increased demand may drive some price competitiveness in high-demand areas. For sellers, the current conditions are promising, with strong buyer interest and mortgage accessibility supporting property sales at healthy price levels.

However, prospective buyers should still consider their long-term financial stability before making a purchase. Although rates are currently favourable, mortgage rates remain higher than pre-pandemic levels, so it’s wise to budget accordingly and consider future rate shifts.

For investors, these conditions also present valuable opportunities. Regions showing particularly strong growth, such as the East of England and East Midlands, are likely to offer promising returns on investment, especially as demand continues to increase. Whether for buy-to-let investments or long-term capital growth, the UK property market is displaying the kind of resilience and growth potential that appeal to investors both domestically and internationally.

Explore Your Options with Northwood

At Northwood, we understand that every buyer, seller and investor is unique. If you’re considering a move or investment, now is the perfect time to take advantage of the favourable market conditions. Our expert team can guide you through the latest trends and help you find the right opportunities in your preferred region.