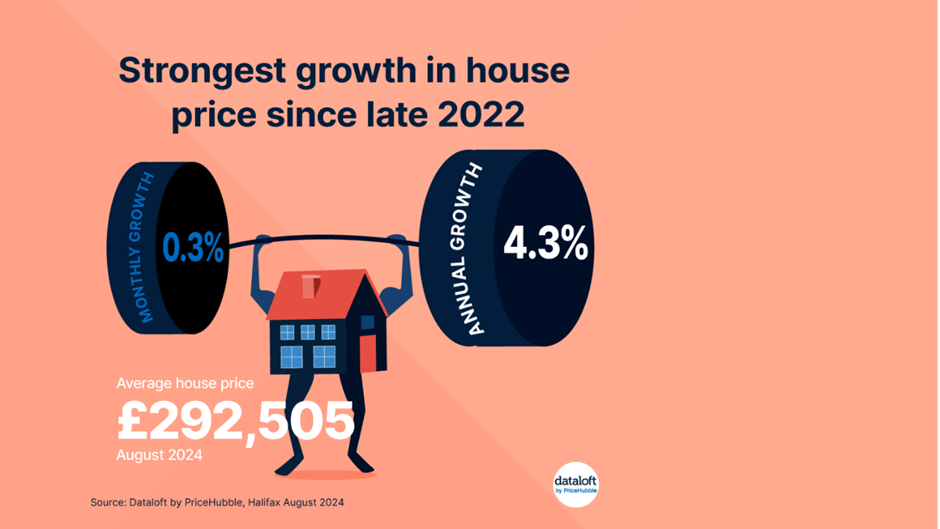

The UK property market continues to show resilience, with house prices edging upwards in August and annual growth reaching 4.3%. This marks the fastest pace of growth since late 2022, reflecting the housing market’s ongoing recovery. While this rise is partly due to comparisons with weaker growth figures from the same time last year, the future of the property market is looking brighter, thanks to several key factors driving buyer confidence and a more optimistic outlook from property professionals.

In this article, we will explore the current trends driving house price growth, what this means for buyers and sellers, and why now might be a good time to consider entering the market.

A Modest Uptick in House Prices

In August, UK house prices rose by 0.3%, a modest but significant increase that builds upon the recent positive momentum in the housing market. With annual growth climbing to 4.3%, this marks the fastest rate of increase since late 2022. Although this growth is partly due to the weaker performance seen in the market during the same period last year, it still highlights a turnaround in the market’s trajectory.

It’s important to note that while house prices have experienced a gradual increase, the pace remains steady rather than rapid. For prospective buyers, this offers some reassurance that the market is not experiencing an unsustainable surge. Similarly, sellers can take confidence in the fact that house prices are moving in the right direction, with a general upward trend that is likely to continue.

Factors Driving Buyer Confidence

One of the key drivers behind the renewed growth in house prices is the boost in buyer confidence, particularly following the Bank of England’s decision to cut interest rates at the beginning of August. The rate cut, combined with mortgage rates trending downwards, has made homeownership more affordable for many buyers, particularly first-time buyers who were previously priced out of the market.

Lower mortgage rates are particularly important in the current market, as they enable buyers to secure more favourable financing options. This, in turn, increases their purchasing power and can allow for more competition in the property market. As a result, more buyers are entering the market with the hope of securing a home before prices rise further.

The expectation of continued stability in mortgage rates is providing a sense of reassurance to both buyers and sellers, who may have been hesitant to make a move in an uncertain financial climate. As a result, we’re seeing more activity in the housing market, which is helping to drive prices upwards.

Property Professionals Expect Prices to Rise Further

The outlook from property professionals is another key indicator of the market’s direction. According to recent data, 37% of property professionals expect sales prices to increase over the next three months. This is a significant shift from the more cautious predictions made earlier in the year, reflecting the more positive sentiment surrounding the housing market.

These expectations are further supported by predictions of a 1.4% house price change throughout 2024, a marked improvement from the -2.2% forecast made at the same time last year. While this predicted growth is not as dramatic as the figures seen in the early stages of the pandemic property boom, it nonetheless indicates a more stable and consistent rise in house prices, which bodes well for both buyers and sellers.

The key takeaway here is that the property market is showing signs of growth and the outlook for the coming months is positive. For sellers, this could be an opportune time to list their properties, while buyers may wish to act sooner rather than later to avoid potentially higher prices in the future.

What Does This Mean for Buyers and Sellers?

For buyers, the current state of the market offers a window of opportunity. With mortgage rates trending downwards and house prices still on the rise, purchasing a home now could potentially save you money in the long run. While prices are edging upwards, they are doing so at a manageable pace, which means that buyers can still find value in the market without feeling pressured by rapidly escalating prices.

First-time buyers stand to benefit from the current conditions. The combination of lower interest rates and steady price growth means that they may be able to secure a more affordable mortgage and find a property within their budget, especially if they act before further price increases.

For sellers, the message is clear: the market is recovering and house prices are rising. This means that now could be a great time to sell, particularly if you’ve been waiting for the right moment to maximise the value of your property. With buyer confidence increasing and more activity in the market, there’s a good chance that your property will attract strong interest.

Looking Ahead

As we move towards 2025, the housing market is expected to continue its upward trajectory, albeit at a more moderate pace than during the peak of the post-pandemic property boom. The predicted 1.4% rise in house prices through 2024 reflects a more stable market environment, which should provide both buyers and sellers with greater confidence in their decisions.

However, it’s important to keep an eye on broader economic factors, such as inflation and potential future changes in interest rates, which could impact the housing market. For now, though, the outlook is positive, with steady growth expected in the coming months.

Now Could Be the Right Time to Act

With house prices growing at the fastest pace since late 2022 and buyer confidence on the rise, now could be the ideal time to make your move in the property market. Whether you’re looking to buy your first home or sell your current property, the current market conditions offer plenty of opportunities.

At Northwood, we’re here to help you navigate the ever-changing property market. If you’re considering buying or selling a home, our team of experts can provide you with the guidance and support you need to make the best decision for your future. Contact us today to find out how we can assist you in achieving your property goals.