The UK rental market has experienced a period of significant growth over the past few years. However, recent data suggests that this rapid pace of growth is beginning to slow. For landlords, understanding these shifts in the market is crucial to making informed decisions about their rental properties. In this article, we will explore the latest data on rental growth, tenant demand and affordability and provide insights into what landlords can expect in the coming years.

Understanding the Recent Slowdown in Rental Growth

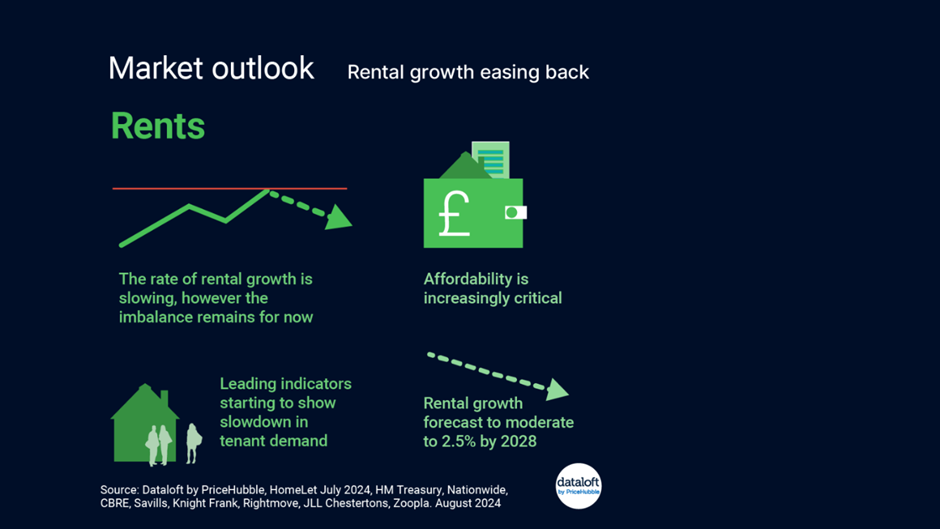

Rental growth in the UK has been notably high in recent years, driven by factors such as increased demand for rental properties and limited supply. However, the latest data from Dataloft by PriceHubble shows that the pace of this growth is now easing. As of August 2024, the annual rental growth rate stands at 5.2%. While this figure still indicates a healthy increase, it is significantly lower than the 10.3% growth observed in July 2023.

This slowdown can be attributed to several factors. First, there has been a noticeable improvement in the supply of rental properties, which is helping to balance the market. Additionally, tenant demand, which had been driving up prices, is starting to soften. These changes suggest that the market is entering a more stable phase, which could be beneficial for both landlords and tenants.

The Role of Affordability in the Rental Market

Affordability is becoming an increasingly critical issue in the UK rental market. According to the latest data, renters were spending an average of 32.7% of their income on rent in July 2024. This represents a slight weakening in affordability across almost all UK regions over the past year. As living costs continue to rise, many tenants are finding it challenging to keep up with rent payments, which could further impact demand.

For landlords, this trend underscores the importance of setting rental prices at a level that is both competitive and affordable. Overpriced properties may struggle to attract tenants, particularly as more rental properties become available and tenants have more choices. By considering affordability, landlords can not only ensure their properties remain occupied but also foster long-term relationships with tenants.

Rental Growth Forecasts

While the current data shows a slowdown in rental growth, it is important for landlords to consider what the future may hold. According to forecasts, rental growth is expected to continue easing back in 2024. This trend is expected to align more closely with earnings growth forecasts, which suggests a more sustainable and balanced market moving forward.

By 2028, rental growth is projected to moderate to around 2.5%. This forecast indicates that while the market may slow, it is unlikely to stagnate. For landlords, this means that while they may not see the rapid increases in rent that have characterised the market in recent years, they can still expect steady, albeit slower, growth over the next few years.

The Impact on Tenant Demand and Supply

The improvement in the supply of rental properties is one of the key factors contributing to the slowdown in rental growth. As more properties become available, tenants have more options, which reduces the competitive pressure that has been driving up rents. This trend is likely to continue as new developments are completed and more landlords enter the market.

At the same time, tenant demand is starting to show signs of easing. This shift could be due to a variety of factors, including the affordability challenges mentioned earlier and potential changes in the broader economic environment. For landlords, understanding these dynamics is crucial to staying ahead of the curve and making strategic decisions about their rental properties.

Strategic Considerations for Landlords

In light of these trends, what should landlords do? First and foremost, it is important to stay informed about market conditions and adjust rental strategies accordingly. With rental growth expected to slow, landlords may need to consider more than just price when attracting and retaining tenants. Offering competitive amenities and maintaining high property standards could be key differentiators in a more balanced market.

Additionally, landlords should keep an eye on the broader economic landscape. As earnings growth and inflation forecasts evolve, these factors will likely influence rental growth and tenant affordability. Staying agile and being prepared to adjust rent levels in response to changes in tenant demand will be essential for maximising rental income while minimising void periods.

At Northwood, we understand that the rental market is constantly evolving, and we are here to help you navigate these changes. Whether you are an experienced landlord or new to the rental market, our team of experts can provide the insights and support you need to make informed decisions about your property. Contact us today to discuss how we can help you optimise your rental strategy and stay ahead in a changing market.