As we approach 2025, the UK property market continues to evolve, shaped by key economic trends, government policies, and shifting buyer and renter demands. Whether you’re considering buying, selling, renting, or investing in property, staying informed about market forecasts is essential. This article explores sales, rental, and buy-to-let growth forecasts for 2025, based on insights from Dataloft by PriceHubble.

Sales Market: Renewed Confidence Drives Growth

2024 marked a turning point for the housing market, with confidence steadily improving as expectations of interest rate cuts fuelled optimism. Although the most recent interest rate reduction has not significantly impacted fixed mortgage rates, it has bolstered sentiment among both buyers and sellers. This renewed confidence is set to drive a modest yet positive price growth in 2025.

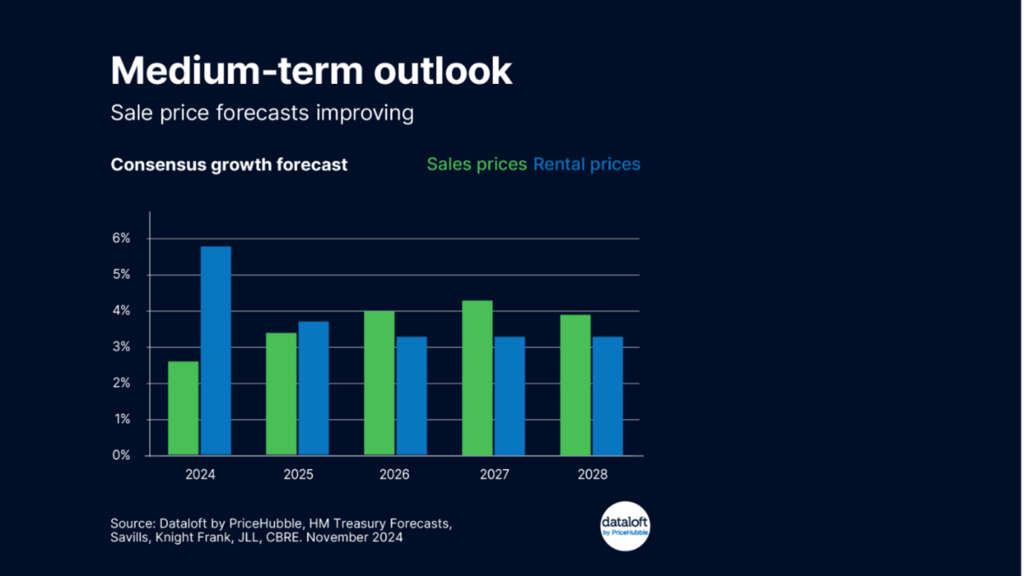

The consensus among experts is that UK house prices will rise by 3.4% in 2025, with growth accelerating to 4% in 2026. These figures reflect a stabilisation of the market following several years of uncertainty. For buyers, this presents an opportunity to enter the market before further price increases, while sellers can anticipate stronger demand.

Key factors underpinning this forecast include:

- A stabilising economy as inflation moderates.

- Improved affordability with reduced interest rates.

- Steady demand for property, particularly in suburban and regional hotspots, as remote working trends persist.

Rental Market: Easing Growth Rates After Record Highs

The UK rental market has experienced exceptional growth in recent years, driven by a combination of rising demand and constrained supply. However, rental growth is expected to moderate in 2025, returning to its long-term trend. This shift follows a period of unprecedented rental increases, which have significantly outpaced wage growth in many areas.

The forecast for rental growth is 3.7% in 2025, slowing slightly to 3.3% in 2026. While these figures represent a deceleration, they still indicate a healthy level of growth, highlighting the resilience of the rental market.

Key drivers of rental market performance include:

- Continued demand from younger renters and professionals unable to step onto the property ladder.

- A shortage of rental stock, as some landlords exit the market due to increased regulation and costs.

- Growth in demand for high-quality, professionally managed rental homes, particularly in urban centres.

For landlords, this presents a double-edged sword: while rental yields remain attractive, increased regulatory pressures and rising costs, such as energy efficiency requirements, will require careful financial planning.

Buy-to-Let Market: Challenges Persist

The buy-to-let sector faces another challenging year in 2025, with confidence dampened by the government’s decision to raise the stamp duty surcharge for additional properties to 5%, introduced in the October 2024 budget. This surcharge adds to an already complex regulatory landscape, making it increasingly costly for new and existing landlords to expand their portfolios.

Despite these challenges, the long-term fundamentals of the buy-to-let market remain strong, particularly in regions where rental demand outstrips supply. Investors should adopt a strategic approach, focusing on areas with high rental yields and strong tenant demand, such as regional cities and commuter belts.

Additionally, landlords can explore opportunities in purpose-built rental developments and energy-efficient properties, which are likely to attract premium tenants and benefit from future-proofing against further government regulations.

Regional Outlook: Where Will Growth Be Strongest?

While national forecasts provide an overall picture, regional trends often diverge. The North West, Midlands, and parts of Scotland are expected to outperform the national average for both price and rental growth in 2025. These regions benefit from:

- Ongoing infrastructure investments, such as HS2 and regional development projects.

- Affordability compared to London and the South East.

- Growing employment hubs in cities like Manchester, Birmingham, and Edinburgh.

Meanwhile, London and the South East are likely to see steadier growth, reflecting their higher property prices and more mature markets.

Opportunities and Challenges for 2025

For property owners, investors, and renters, 2025 offers a mix of opportunities and challenges:

- For buyers and sellers: A more stable market with moderate price growth provides opportunities for well-timed transactions.

- For renters: Slower rental growth may bring some relief, although competition for high-quality properties remains fierce.

- For landlords: Strategic investment and careful financial planning are critical to navigating regulatory pressures and rising costs.

Planning Your Next Property Move

Whether you’re considering buying, selling, renting, or investing in 2025, preparation is key. The UK property market remains dynamic, influenced by economic shifts, government policies, and regional trends. At Northwood, we offer expert advice tailored to your needs, helping you make informed decisions.

Get in touch with our local team to discuss how you can capitalise on opportunities in 2025. From sales and lettings to property management and buy-to-let investment, we’re here to support you every step of the way.