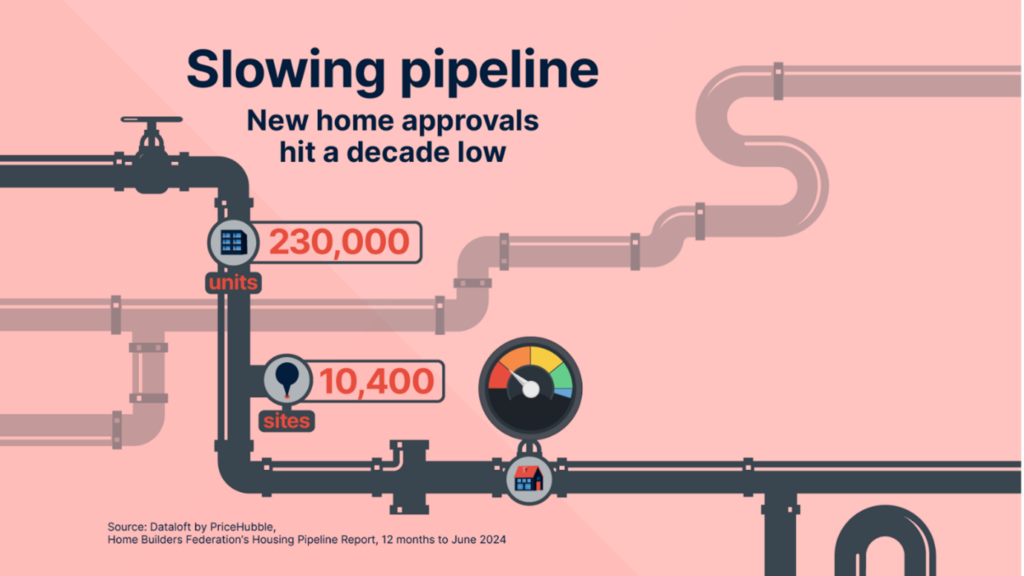

The latest figures from the Home Builders Federation’s Housing Pipeline Report, sourced via Dataloft by PriceHubble, bring concerning news for landlords, investors, and those interested in the UK housing market. The report highlights a significant drop in the number of new home planning approvals, marking a critical issue that could impact housing supply, investment opportunities, and rental markets across the country. Let’s explore the key findings and their implications for landlords in detail.

A Steady Decline in Planning Permissions

The report reveals that just over 230,000 units were granted planning permission in the past 12 months. This is the lowest figure in the last decade. For context, this figure represents a substantial decline in planning approvals compared to previous years, which could signal a slowdown in housing developments in the short-to-medium term.

For landlords, this dip in approvals might exacerbate the ongoing imbalance between housing demand and supply. With fewer new homes being built, competition for existing housing stock could drive up property values and rental prices, potentially creating an opportunity for landlords but posing challenges for prospective tenants.

Lowest Number of Sites Approved Since 2006

Another startling finding from the Housing Pipeline Report is that just 10,400 sites were approved for development over the same 12-month period. This is the lowest level recorded since the report began in 2006. Such a sharp decline raises concerns about the future pipeline of housing development, particularly at a time when the UK is grappling with a well-documented housing crisis.

The significance of this drop cannot be overstated. For landlords, fewer sites gaining planning permission means fewer opportunities to invest in new-build developments. In addition, a constrained housing supply could mean higher rental yields for existing landlords, but it also highlights a growing issue: the inability of the market to meet demand for quality, affordable housing.

Challenges for the New Government

The decline in planning approvals also highlights the scale of the challenge facing the new Government in addressing housing supply. While planning permissions have been a focus for policymakers, these latest figures demonstrate a worrying trend that must be reversed to ensure sufficient housing stock for future generations.

Landlords, investors, and property managers should keep a close eye on housing policies and planning reforms introduced by the Government in the coming months. Efforts to streamline the planning process, increase housing targets, or incentivise development could present new opportunities for landlords while also alleviating the current supply constraints.

Implications for Landlords

For landlords, the declining number of new home approvals brings both challenges and opportunities:

- Increased Demand for Rental Properties: With fewer new homes entering the market, the demand for rental accommodation could increase, particularly in areas of high population growth.

- Higher Rental Yields: A limited supply of new homes may drive up rental prices, offering potential for increased yields for landlords with existing properties.

- Investment Opportunities: For those able to invest in new-build developments, properties in areas with strong demand and limited supply could deliver excellent long-term returns.

However, landlords must also be mindful of the broader implications of this trend. As housing supply continues to lag behind demand, issues such as affordability and competition for quality rental homes could intensify, requiring landlords to balance profitability with tenant needs.

What Does This Mean for the Future?

The drop in planning approvals is a wake-up call for the UK housing sector. It underscores the need for a more efficient and effective planning system to ensure the supply of new homes keeps pace with demand. For landlords, this trend presents both risks and rewards. While existing properties may see increased rental demand, the lack of new development opportunities could limit portfolio growth in the years to come.

Staying informed about housing trends, government policies, and local market conditions will be essential for landlords looking to navigate this evolving landscape. Partnering with a trusted estate agent, like Northwood, can provide valuable insights and support as you plan your next steps.

Stay Ahead of the Curve

The decline in new home planning approvals is a significant development for landlords and investors across the UK. As the Government grapples with the challenge of increasing housing supply, landlords have an opportunity to adapt, invest, and support the growing demand for rental properties.

At Northwood, we’re here to help you stay ahead of the curve. Whether you’re looking to expand your property portfolio, optimise your rental yields, or navigate the ever-changing property market, our expert team is on hand to provide guidance and support.

Get in touch with Northwood today to discover how we can help you make the most of your property investments.