A Positive Outlook for UK Homebuyers

For those looking to purchase a home or remortgage in the UK, recent developments in the mortgage market are bringing some much-needed optimism. Following a period of higher interest rates, mortgage rates are now starting to fall, creating a more favourable environment for potential buyers and homeowners alike. As of September 2024, the Bank of England held its rate steady at 5%, having previously cut it in August, and there is talk of further reductions on the horizon. In this article, we will explore the factors driving these improvements and what they could mean for the housing market in the coming months.

Bank of England’s Decision and the Future of Rates

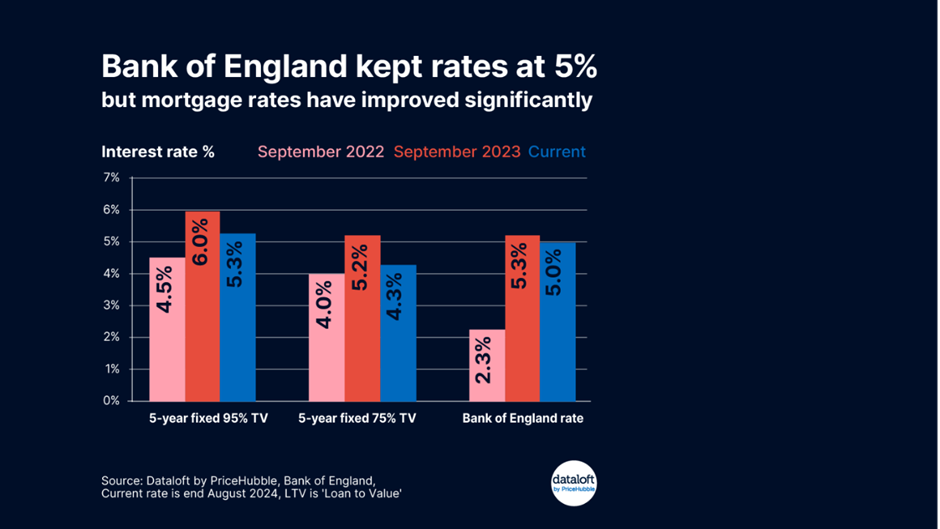

At its September 2024 meeting, the Bank of England chose to keep its base rate at 5%. This decision followed a cut in August, which had marked a shift in the central bank’s approach after a series of rate hikes aimed at curbing inflation. The Bank indicated that further cuts could be implemented if inflation remains under control, providing additional relief to mortgage holders.

According to the latest forecasts from HM Treasury and Dataloft by PriceHubble, the Bank of England’s base rate is expected to decrease further, with a predicted rate of 4.7% by the fourth quarter of 2024. This suggests that we may see one more 25 basis point cut before the end of the year. With inflation gradually easing, the likelihood of further cuts increases, which will likely have a knock-on effect on mortgage rates, making borrowing cheaper for those looking to enter the housing market or remortgage their properties.

Falling Mortgage Rates: What It Means for Buyers

The impact of these changes is already being felt in the mortgage market. Over the past year, mortgage rates have fallen significantly as lenders begin to price in the potential for further interest rate cuts. This is a substantial reduction from the 5.2% rate seen a year ago and only slightly higher than the rate of 4.0% that was available in September 2022.

This trend is great news for prospective homebuyers who have been grappling with higher borrowing costs over the past year. Lower mortgage rates mean lower monthly repayments, making homeownership more affordable. For existing homeowners looking to remortgage, these reductions also present an opportunity to secure a more favourable deal than might have been available just a few months ago.

Increased Competition in the Mortgage Market

One key factor contributing to the downward pressure on mortgage rates is the increased competition among lenders. As inflationary pressures ease and the Bank of England signals further rate cuts, mortgage lenders are positioning themselves to attract more business by offering more competitive rates. This competition is expected to drive rates even lower over the next few months, providing an additional incentive for buyers and those looking to remortgage.

The recent interest rate cut in the United States has had a ripple effect on global financial markets, including here in the UK. The US Federal Reserve’s decision to lower rates indicates that inflation is under control in the world’s largest economy, which bodes well for the global economic outlook. This development further supports the possibility of more rate cuts in the UK, creating a more stable and favourable environment for both lenders and borrowers.

What This Means for the Housing Market

The prospect of lower mortgage rates is likely to have a positive impact on the UK housing market. Over the past year, higher interest rates have contributed to a cooling of the market, as many potential buyers were priced out by the increased cost of borrowing. However, with mortgage rates now falling and further reductions expected demand for housing is likely to pick up once again.

For sellers, this could mean an increase in buyer interest, leading to more competition for properties and potentially stabilising or even boosting house prices. For buyers, the current environment represents an excellent opportunity to take advantage of falling rates and secure a home loan at a more affordable level.

Looking Ahead: A More Stable Market?

While it is impossible to predict the future with complete certainty, the current trajectory suggests a more stable and predictable housing market in the months ahead. With inflation under control and the Bank of England likely to make further cuts to its base rate, both buyers and sellers can look forward to a period of relative calm compared to the turbulence of the past year.

If you are considering buying a property or remortgaging your home, now could be the perfect time to take advantage of these improving conditions. With mortgage rates already on the decline and further reductions on the cards, securing a deal sooner rather than later may prove to be a smart financial move.