The prospect of interest rates being cut from August is gaining traction among financial analysts and institutions. Recent insights from Dataloft PriceHubble and HM Treasury forecasts provide a comprehensive overview of the anticipated changes. This article explores the reasons behind the forecasted interest rate cuts, their potential impact on the UK economy and what it means for homeowners and buyers.

European Central Bank Leads the Way

On 6th June, the European Central Bank (ECB) cut its central bank rate for the first time in nearly five years. This proactive measure sets a precedent, positioning the ECB ahead of both the US Federal Reserve and the Bank of England, which are yet to reduce their rates. This move by the ECB underscores a broader trend of easing monetary policy to support economic stability and growth.

Current Economic Climate in the UK

The UK is witnessing a gradual easing of inflationary pressures. The latest data from April indicated a headline Consumer Price Index (CPI) rate of 3%. Despite this positive trend, certain segments of the economy continue to experience inflationary strains.

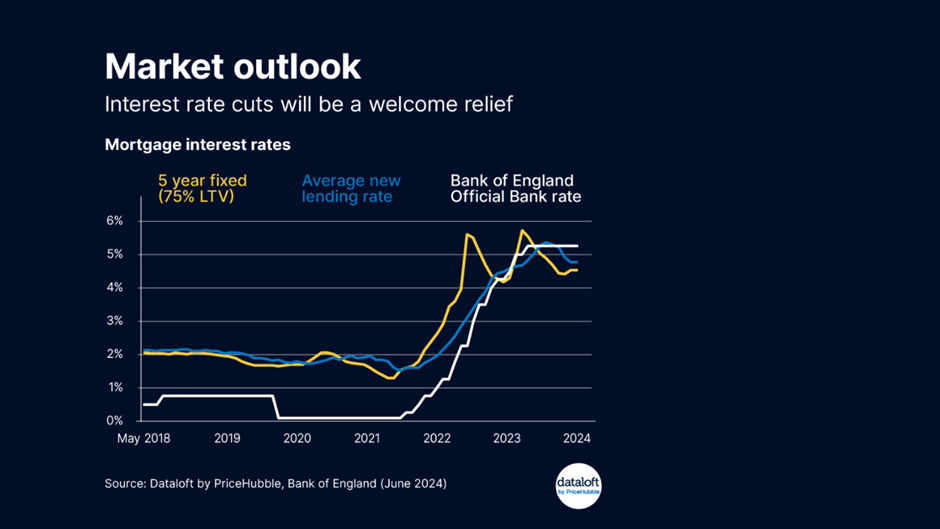

Forecasted Changes in Interest Rates

According to HM Treasury’s consensus forecasts, the bank rate is projected to decrease from the current 5.25% to 4.5% by the end of 2024. Earlier this year, mortgage rates saw a slight dip but have since plateaued as anticipated interest rate cuts were deferred to the latter half of the year.

Insights from Recent Bank of England Meetings

At the most recent meeting on 20th June, the Bank of England held rates at 5.25%, with a voting pattern similar to May’s meeting: seven members voted for no change, while two advocated for a 0.25 percentage point cut. Inflation reaching the target 2% for the first time since July 2021 significantly influenced this decision. Despite the hold, the tone of the Bank’s messaging indicated that the decision was finely balanced.

Michael Field, European market strategist at Morningstar, highlighted that the Monetary Policy Committee (MPC) is closely following economic data. With inflation data moving in the right direction, rate cuts are anticipated to follow.

Divergent Views within the Bank of England

Not all policymakers are convinced that the recent drop in inflation from over 11% in 2022 to 2% in May 2024 is sustainable. Some members are calling for more data to confirm a persistent decrease in inflation before committing to reducing the degree of monetary policy restrictiveness. Concerns remain about potential inflationary pressures towards the end of the year, driven by comparisons with 2023’s energy bill anomalies rather than an actual increase in the cost of living.

The Bank of England is also monitoring services inflation, which stood at 5.7% in May, and core inflation at 3.5%. Core CPI is considered a more realistic measure of price pressures within the UK economy.

Upcoming Economic Indicators

July promises to be a pivotal month for the UK, with no scheduled Bank meeting but significant data releases expected. Inflation numbers due on 17th July and wage data on 18th July will provide crucial insights ahead of the August interest rate decision. Additionally, the Bank’s MPC will welcome a new member, Clare Lombardelli, replacing Ben Broadbent.

Governor Andrew Bailey has previously noted that even a single rate cut would maintain restrictive monetary policy. Given the significant rate increases since December 2021, the Bank is cautious about potential policy errors that could necessitate reversing rate cuts if unforeseen economic challenges arise.

The anticipated interest rate cuts from August present an important development for the UK economy. Homeowners and potential buyers should stay informed about these changes, as they can significantly impact mortgage rates and overall financial planning.