The UK housing market has shown signs of steady recovery after starting the year on a somewhat cautious note. According to recent data from Dataloft by PriceHubble, the year began with a slight moderation in house prices, but positive momentum has returned by mid-year. This shift in the market has given both buyers and sellers renewed confidence, as the average property price now stands at £287,927. Let’s explore the factors contributing to this recovery, regional trends and what this means for the market going forward.

A Gradual but Steady Recovery

At the start of 2024, the UK housing market experienced a dip, with an annual house price growth of -1.7%. This reflected the cooling down of the market, driven by external factors such as rising interest rates and inflation pressures. However, by June 2024, the annual house price growth had bounced back to a positive 2.7%. This recovery in house prices is a strong indicator that the market is stabilising after the challenges of the past year.

The increase in house prices is encouraging for both current homeowners looking to sell and buyers hoping to enter the market. For those who have held off selling their homes, the upward trend in property values provides an opportunity to secure better returns. Meanwhile, buyers can take heart that while prices are rising, they remain within reach, especially with more stable economic conditions on the horizon.

Regional Differences: Who’s Leading the Way?

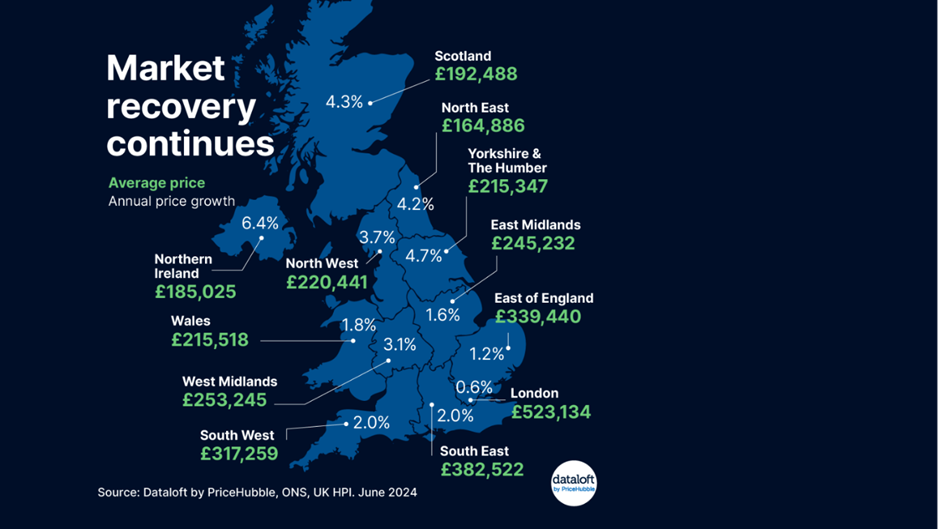

One of the key trends identified in the recovery is the varying pace of house price growth across different regions of the UK. For the first time since April 2023, all UK regions are now recording positive annual price growth, with some regions standing out more than others.

Northern Ireland is currently leading the way with the strongest growth, experiencing a significant 6.4% increase in house prices. This is followed by Yorkshire and the Humber, where house prices have risen by 4.7%, and Scotland, with a 4.3% increase. These figures suggest that certain areas are benefiting from higher demand or unique economic factors driving growth at a faster rate.

Regions that may have struggled earlier in the year are also seeing improvements. For example, London, which has experienced a slower pace of growth in recent years due to affordability constraints, is starting to see more stability in its market. Although it may not be growing as quickly as other regions, the capital still offers a resilient market for investors and buyers alike.

A Stable Economy Supports Market Confidence

One of the main reasons behind the housing market’s recovery is the stabilisation of the broader economic environment. Inflation, which had been a significant concern for the property market throughout much of 2023, is now under control. This has helped to ease the pressure on household budgets and has had a knock-on effect on the housing market.

Interest rates, which reached highs last year, have now taken their first steps downward. This reduction in interest rates has made mortgage lending more accessible for prospective buyers. Lower borrowing costs mean that more people can afford to buy homes, which is boosting demand and driving price growth across the country.

As inflation continues to moderate and interest rates remain favourable, we expect confidence in the housing market to strengthen further. This positive economic backdrop will likely encourage more transactions and ensure that the recovery we’re seeing continues throughout the rest of the year.

What Does This Mean for Buyers and Sellers?

For buyers, the housing market recovery offers an encouraging sign. With inflation under control and interest rates stabilising, the market presents opportunities for both first-time buyers and those looking to move up the property ladder. Property prices are rising, but they are doing so at a measured pace, which still allows room for negotiation and finding good value, especially in regions like Northern Ireland, Yorkshire and Scotland where growth is leading the way.

Sellers, too, have reason to be optimistic. With property prices on the rise, those looking to sell their homes are likely to achieve better offers than they might have earlier in the year. This, combined with higher buyer confidence, means that homes are less likely to stay on the market for long, making it a good time to list a property for sale.

Looking Ahead

As we move into the latter stages of 2024, the outlook for the UK housing market is increasingly positive. While challenges remain, such as navigating mortgage approvals and adjusting to economic shifts, the overall trajectory suggests that hopefully the worst of the housing market’s recent downturn is behind us.

The steady rise in house prices across all UK regions is a particularly promising sign. It indicates not just a recovery but the potential for sustained growth over the coming months. As inflation stays in check and interest rates remain favourable, buyers and sellers alike can expect a more balanced, stable housing market environment.

For those considering buying or selling property, now is a promising time to act. The housing market’s recovery is well underway, and with all regions showing positive price growth, the opportunities for securing a good deal are growing. Whether you’re a first-time buyer looking to enter the market or a homeowner ready to sell, the stabilising economic conditions provide a window of opportunity.

At Northwood, we’re here to help you navigate this dynamic market. With our local expertise and knowledge of regional trends, we can assist you in making informed decisions, whether you’re looking to buy, sell or invest in property.

Contact us today for a free property valuation or to discuss how we can help you achieve your property goals.