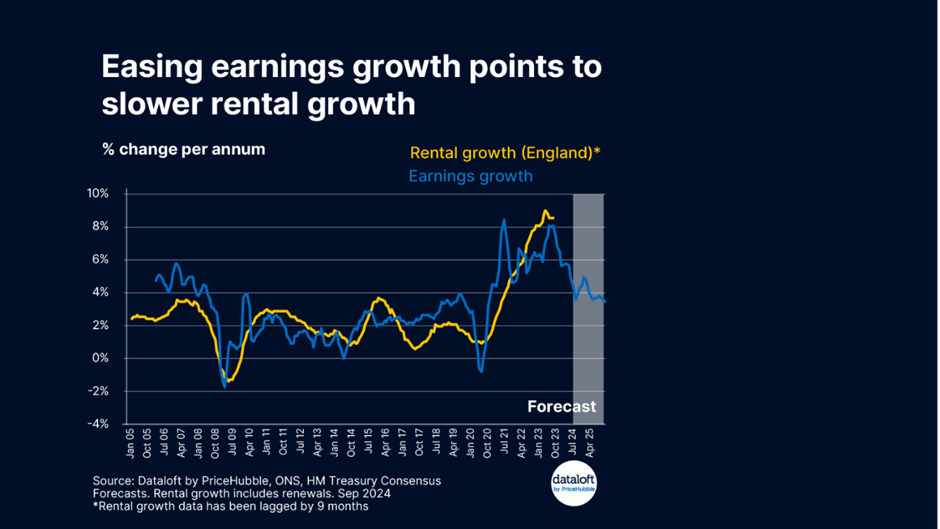

The interplay between earnings growth and rental growth is a crucial topic for landlords and property investors to understand. Over the long term, there is a very strong relationship between the two, with wages and rental prices moving in tandem. As tenants experience changes in their income, their ability to meet rental costs shifts as well, directly influencing the rental market. This connection is particularly important for landlords seeking to understand the direction of rental prices and for those making informed decisions regarding their investment properties. In this article, we will explore the dynamics between earnings growth and rental growth, examining recent trends and what the future may hold for the rental market.

The Correlation Between Earnings and Rent

Historically, there has been a clear relationship between earnings and rental growth. When wages rise, tenants have more disposable income, allowing them to afford higher rents. Conversely, during periods of wage stagnation or decline, rental growth tends to slow, as tenants are unable to keep up with increasing rental prices. This connection reflects the natural balance between what tenants can afford and what landlords can charge.

The rental market is sensitive to changes in household income and as such, earnings growth is a significant driver of rental growth. For landlords, this relationship offers a key insight into how the rental market might evolve over time. Understanding this relationship can help landlords anticipate potential shifts in rental income, allowing them to better plan for property investment and management.

Recent Trends in Earnings Growth

According to the latest earnings data, released earlier this month, the UK is seeing a lower growth rate in wages, with annual average growth at 4.4%. This is the first time earnings growth has reached this level since the end of 2020. While 4.4% growth may still seem substantial, it represents a notable deceleration compared to the rapid wage growth witnessed over the past few years.

Several factors are influencing this slowdown in earnings growth. The UK economy has been grappling with various pressures, including inflation, higher interest rates and uncertainty in the global markets. As a result, many businesses are limiting wage increases to manage costs, contributing to the moderation in earnings growth.

For landlords, this slower wage growth has direct implications for rental prices. As tenants experience more modest increases in their income, they may be less willing or able to absorb significant rent hikes. Therefore, rental growth is also expected to moderate in line with these earnings trends.

How Earnings Growth Impacts the Rental Market

The impact of earnings growth on rental prices can vary depending on the type of rental agreements in place. One key distinction is between new rental agreements and rental renewals. Rental data that includes renewals tends to show slower changes than open market lets. This is because tenants who are renewing their leases often experience smaller rent increases compared to those entering new leases, where rents are set based on current market rates.

For landlords with long-term tenants, this means that rental income growth may not immediately reflect the overall market trends. However, the direction of travel is clear: rent rises for those renewing leases, as well as those on new leases, will continue to moderate in response to slower earnings growth.

While this might initially seem like a negative development for landlords, it’s important to remember that stability in the rental market can also be beneficial. A more gradual increase in rents can help to retain reliable tenants, reduce vacancy rates and minimise turnover costs. Moreover, a steady income stream, even if it grows more slowly, is often preferable to the uncertainty of significant rent increases followed by tenant churn.

The Current Outlook for Rental Growth

Given the current economic climate and the slowdown in earnings growth, the rental market is expected to follow suit with more moderate rent increases. According to various forecasts, while rental growth will not disappear, it is likely to slow in the near term, aligning with the deceleration in wage growth.

Landlords can expect more modest rent increases for both new tenants and those renewing their leases. However, it’s important to stay vigilant, as regional variations in the UK can lead to different trends in different markets. For instance, areas with strong demand and limited housing supply may still see higher rental growth despite the broader trends.

While earnings growth has slowed, inflation and the cost of living remain concerns for many tenants. Landlords may need to balance their rental expectations with what the market can bear, ensuring they remain competitive and attract quality tenants.

Preparing for Future Changes

For landlords, the key to navigating this period of slower earnings and rental growth is adaptability. While rental income may not rise as quickly as it did in previous years, landlords can take proactive steps to protect their investments:

- Maintain Competitive Rents: Ensuring that rents are in line with local market conditions will help to attract and retain tenants. Competitive pricing can reduce vacancy rates and keep rental income steady.

- Enhance Property Appeal: Offering well-maintained properties with modern amenities can help landlords stand out in a competitive market. Tenants are often willing to pay a premium for properties that offer added value in terms of comfort, convenience and location.

- Consider Long-Term Tenancies: Encouraging longer tenancies can provide landlords with more security and reduce the costs associated with turnover. Offering incentives, such as minor rent reductions for long-term tenants, could help to retain reliable tenants in the face of slower rental growth.

At Northwood, we understand the importance of staying informed about the latest market trends to make the most of your property investment. Our team of experts can help you navigate the evolving relationship between earnings growth and rental growth, offering guidance on how to maximise your rental income while maintaining tenant satisfaction. If you’re a landlord looking for professional advice or property management services, get in touch with Northwood today to find out how we can help you achieve your goals.