For decades, property has been a cornerstone of investment in the UK. It has consistently outperformed inflation over the long term, offering security and robust returns. But recent years have seen the buy-to-let market decline significantly. In this article, we explore insights from Dataloft by PriceHubble and other sources to understand why this shift is occurring and what it means for landlords.

The Appeal of Property Investment

Traditionally, property has been a favoured investment avenue in the UK for several reasons. Unlike most other investments, a primary residence is exempt from capital gains tax, making it an attractive prospect for homeowners. This tax relief, coupled with the potential for long-term appreciation, has encouraged many to enter the property market.

For decades, buy-to-let properties were especially appealing. Landlords could rely on steady rental income while benefiting from capital growth. Historically, the ability to offset mortgage interest and other costs against rental income provided a tax-efficient route to profitability. However, the landscape has shifted significantly in recent years.

First-Time Buyers: Supported and Incentivised

Government policies have long aimed to help first-time buyers (FTBs) get onto the property ladder. Stamp duty concessions, initiatives like Help to Buy, and support from the so-called “Bank of Mum and Dad” have made it easier for younger generations to purchase homes.

Even amid higher interest rates, first-time buyers remained active borrowers throughout 2023 and 2024, although at slightly reduced levels compared to the market peak of 2021–2022. This continued demand highlights the resilience of this group, buoyed by targeted support and the long-term aspiration to own property.

The Squeeze on Buy-To-Let Investors

In stark contrast to the incentives for first-time buyers, buy-to-let investors have faced mounting financial and regulatory pressures. The past decade has seen a steady erosion of the tax benefits that once made buy-to-let an attractive prospect. For example:

- Mortgage interest relief for landlords has been gradually phased out since 2017, replaced by a basic-rate tax credit.

- Stamp duty surcharges for additional properties were introduced in 2016 and increased from 3% to 5% in the Autumn Budget 2024.

- Stringent lending criteria have been imposed by mortgage lenders, reflecting higher interest rates and increased risks.

The cumulative effect of these changes has significantly reduced the profitability of buy-to-let investments. For many landlords, the numbers no longer stack up as they once did.

The Impact of Rising Interest Rates

Another critical factor contributing to the decline of the buy-to-let market is the rise in interest rates. As borrowing costs increase, so too do the monthly repayments on buy-to-let mortgages. This has squeezed profit margins, particularly for those who bought properties with high loan-to-value (LTV) ratios.

For landlords reliant on variable-rate mortgages, the financial strain has been even more acute. Fixed-rate deals, which offer some protection against rising rates, have also become more expensive, further dampening enthusiasm for new investments.

Why Buy-To-Let Borrowing Lags Behind

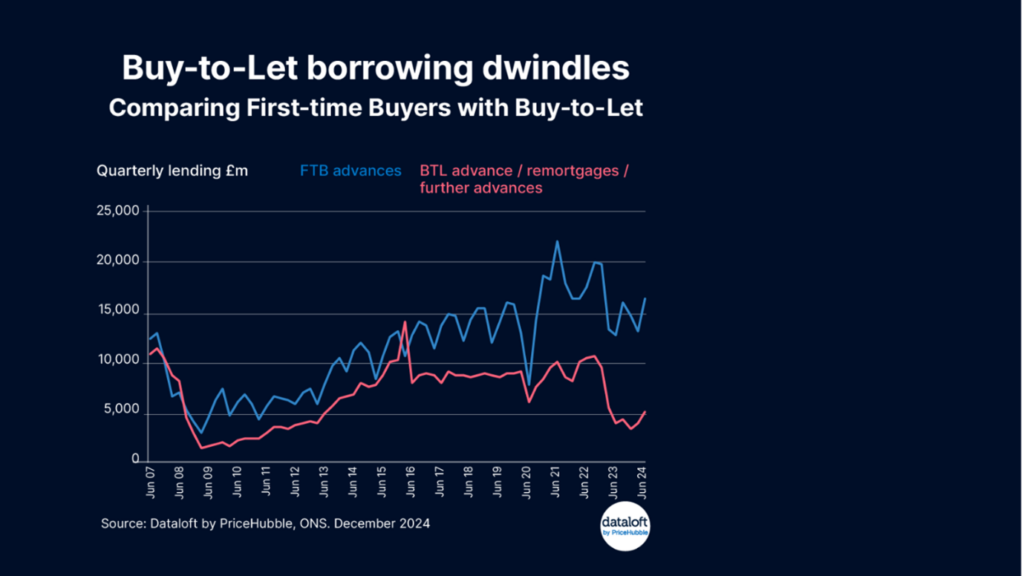

Data from Dataloft by PriceHubble and the Office for National Statistics (ONS) reveals a growing disparity between the volumes borrowed by first-time buyers and buy-to-let investors. While first-time buyers have benefited from sustained support and a strong cultural drive toward homeownership, buy-to-let investors face a host of challenges:

- The tax burden has increased significantly.

- Property management has become more complex and regulated.

- Rising interest rates have eroded profitability.

These factors have caused many would-be landlords to reconsider entering the market, while some existing landlords are choosing to exit altogether. The result is a notable decline in buy-to-let borrowing and activity.

What This Means for the Rental Market

The decline in buy-to-let investment has knock-on effects for the rental market. With fewer landlords entering the sector and some existing ones selling their properties, rental supply is tightening. This imbalance between supply and demand has led to rising rents in many parts of the UK, putting further pressure on tenants.

At the same time, the government has introduced reforms to improve tenant protections, such as proposals to abolish Section 21 ‘no-fault’ evictions. While these measures aim to create a fairer rental market, they also increase the responsibilities and risks faced by landlords.

Navigating the Changing Landscape

For landlords, the changing buy-to-let landscape presents both challenges and opportunities. Strategic planning and professional advice are more critical than ever. Northwood estate agents are here to help you navigate these complexities, offering expert guidance on everything from property selection to tenancy management.

Whether you’re considering expanding your portfolio, adjusting your investment strategy, or exiting the market, Northwood’s team can provide the insights and support you need to make informed decisions.

A New Era for Property Investment

The buy-to-let market has undoubtedly entered a period of significant change. Rising interest rates, increased taxation, and tighter regulations have combined to reduce its appeal compared to previous years. However, property remains a resilient and versatile asset class. With the right approach, landlords can continue to achieve their financial goals.

If you’re a landlord looking to adapt to this evolving market, contact Northwood today for expert advice and tailored solutions. Let us help you make the most of your investments.